Our mission is to ensure the ongoing fiscal integrity of the University through the effective management of all of its Fixed Assets (Land, Buildings, Infrastructure, Equipment, Vehicles, Software, Library Books, etc.) policies. This includes the review and analysis of capital building projects, the capitalizing of all University Fixed Assets, the maintaining of an accurate Fixed Assets System, and the conducting of annual inventory audits. The Fixed Assets Accounting Group is responsible for providing financial reporting to the University, the Commonwealth, and other regional and national agencies, including federal sponsors such as NASA and the Department of Defense. We are also responsible for administering the Equipment Trust Fund (ETF) program.

- Defining Fixed Assets

-

Characteristics of fixed assets include:

-

Tangible property having an individual cost equal to or greater than the necessary threshold (dependent upon the type of asset)

-

A useful life of greater than one (1) year

-

Cost of the asset depreciated over its useful life

-

Capital Leases and Leasehold improvements

-

Gift donations provided the gifted item meets a necessary threshold

-

Assets used in the day-to-day operations (education, administration, and research) of the University but are not consumed during normal operations (i.e., like supplies)

-

Assets capitalized in UVA's financial books

Four Main Categories of Fixed Assets:

-

Land: Acquisitions and gifts of parcels of real property are capitalized regardless of value and considered non-depreciable assets because land typically holds its value unless depleted such as in a land-mining operation.

-

Buildings: Permanent roofed structures which are suitable facilities for people, animals, vegetation or equipment which meet the capital threshold of $250,000. This would include both the construction and/or purchase of new buildings.

-

Equipment: Capital equipment is personal tangible property with an individual threshold cost of $5,000 consisting of any or ALL of the following: 1) the purchase cost, 2) freight cost, 3) installation cost and 4) the cost of internal software (excluding yearly licenses) required to operate the equipment (provided it comes along with the equipment). Costs which are NOT allowed as part of the capital equipment are: 1) Other software applications which may run on the equipment 2) Equipment maintenance or service contract costs, 3) Cost of equipment training (on-site or off-site). Note: No sales tax should be charged to UVA for any equipment purchases as the University is tax-exempt.

-

Exception: Equipment which meets SCHEV guidelines as ETF equipment has a lower threshold of $500 but these items are still treated as capital equipment.

-

-

Major Software: Includes both externally purchased software, software upgrades as well as internally developed software with a minimum threshold cost of $250,000.

-

- Physical Inventory Process

-

-

The Fixed Assets Equipment Physical Inventory Process is conducted annually and includes both:

-

1) Self-Audits performed by the orgs (departments) for those buildings having less than 25 assets or where certain labs/rooms are inaccessible

-

2) equipment scanning performed by the Fixed Assets Accounting (FAA) Group.

-

-

Upon completion of the Self-Audits and scanning operation, “Not Found” reports reflecting unaccounted for equipment assets are sent by the FAA Group to each org for its review/corrections to be submitted to FAA.

-

All inventory changes or corrections are reviewed and processed into the Fixed Assets Sub-Ledger Module by FAA

-

“Final Inventory Certification” reports, summarizing missing equipment assets, are sent to the org chairs by FAA which require their signatures to finalize the inventorying process.

-

Equipment assets deemed "missing" for two consecutive inventory cycles will be written-off in the subsequent fiscal year and removed from the Fixed Assets sub-ledger system.

-

NOTE: Special emphasis is placed upon sponsor or Government-owned equipment which requires FAA to physically inventory all such equipment on an annual basis

-

- Equipment Coordinators

-

Collaboration between the Fixed Assets Accounting Group and Equipment Coordinators is essential. The role of an Equipment Coordinator includes duties such as:

-

Providing the Fixed Assets Accounting Group with information for ALL equipment-related activity including when:

-

Equipment location has permanently changed;

-

Equipment has been assigned an off-grounds location;

-

Equipment is missing; or

-

Equipment has been disposed of or destroyed.

-

-

Reviewing equipment inventory reports to ensure their organization has properly accounted for all equipment.

-

Staying up-to-date on and adhering to equipment policies and procedures.

-

- Requirements for Equipment Changes

-

Disposals

A P-1 form is only required for equipment to be scrapped, cannibalized, or being traded-in, or has been lost or stolen. It is not required for equipment being surplussed through Facility Management’s Surplus Property process.

Transfer of Equipment to Another Institution

-

New Doc Request (Use this doc request and follow procedure listed below)

Equipment Located Off-Grounds

Equipment which is maintained or transferred to an off-grounds location.

Transfer of Responsibility to Another Org within UVA Academic

Equipment transfer should be a permanent transfer. ("Permanent" means minimum of 6 months.)

Location & Responsible Person Changes/Corrections

Location & Responsible Person changes/corrections /updates are done via email and should be sent to: fixedassets-property-request@virginia.edu (no form needed).

- Choosing the Correct Expenditure Type

-

When it comes to Fixed Assets accounting, it is crucial to understand the importance of selecting the correct Expenditure Type (the 'E' segment of the PTAEO) in order to properly categorize equipment purchases. The Expenditure Type is the core data element used for Fixed Asset reporting.

Only equipment purchased with the Expenditure Types that start with 'Eq Capital' flow into the Fixed Asset module. If the original Expenditure Type used is incorrect, a cost transfer correction must be completed via the Grants Accounting (GA) Module in the Integrated System.

- Note: In addition to choosing the correct Expenditure Type, purchasers must also create accurate equipment descriptions in order to properly identify equipment that should be capitalized in the Integrated System.

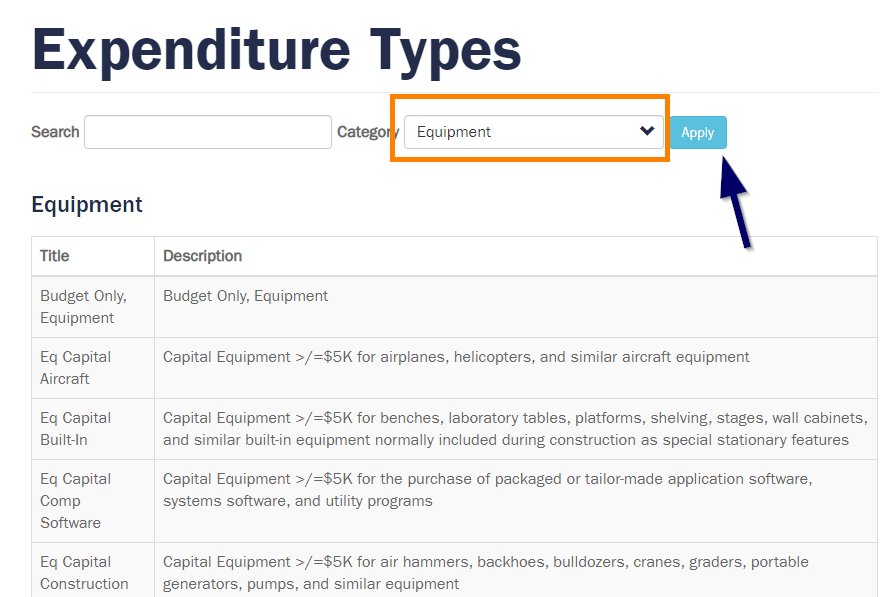

Refer to the Expenditure Type Search for more information related to Capital and Non-Capital Equipment expenditure types.

- Choose the "Equipment" category and then click Apply.

Contact the Fixed Assets Accounting Group for any questions related to selecting the correct Expenditure Type and creating accurate equipment descriptions.

- Related Policies and Resources

-

FIN-030: Purchase of Goods and Services (Lease versus Purchase)

FIN-013: Permanent Transfer of Equipment Assets to or from the University

FIN-034: Accounting Requirements for Equipment Assets

FIN-043: Managing Export and Sanction Compliance in Support of University Activities

FIN-052: Fixed Assets Accounting and Reporting of Equipment Acquired for Sponsored Programs

PRM-011: Use of Working Time and University Equipment for Personal or Commercial Purposes

PRM-016: Surplus Property Disposal

Procedure for Requesting Changes to Capital Equipment

Facilities Management - Surplus Property

For additional information related to Fixed Assets Accounting, see the staff listing and duties on the Contacts webpage.