If you've ever wondered why UVA can't use its endowment to fill budget gaps or had someone ask you why we have to raise tuition when we have such a healthy endowment, you're not alone.

- Check out our Endowment Fact Sheet.

- View our Endowment Video (the data is a couple of years old, but it's a great explanation of how endowments work)

UVA's Endowment Supports Excellence

As a public institution, UVA’s mission is to educate students who have earned a place in the class based on their academic merit, regardless of their financial situation. The University is consistently lauded by national publications as one of the nation’s best values in higher education. It has also been commended for graduating students on time with lower-than-average debt coupled with higher-than-average earning potential.

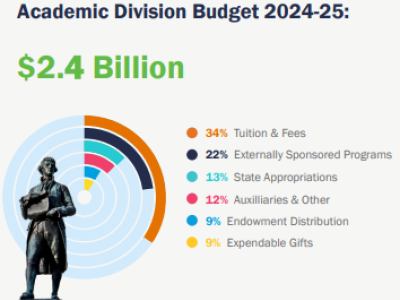

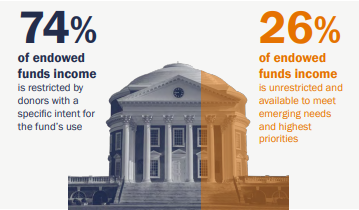

An essential source of permanent support

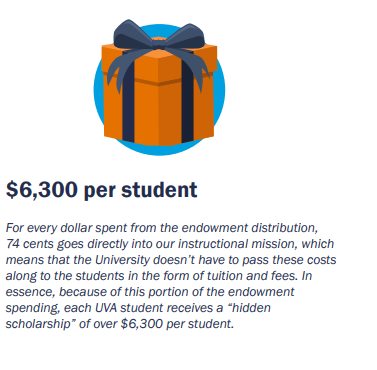

Philanthropic gifts have a profound effect on the quality of education, research and patient care at the University, and they enhance affordability for our students. Donors may restrict gifts to a particular school, department, program or scholarship or leave gifts unrestricted to meet general University needs as they arise. Many gifts are set aside in the University’s endowment with the intention that the principal itself will not be expended but will remain invested to provide future investment returns. Spending from the endowment’s investment return is essential to provide a reliable, predictable and sustainable source of professorships, scholarships and fellowships. This spending also supports resources for students and faculty that enhance education, research and patient care at UVA. This year, the spending from the endowment’s investment return will provide 13% of UVA’s Academic Division budget, the equivalent of $7,400 per student. For the last 15 fiscal years, earnings from the endowment has increased, becoming a vital funding stream.

Investing responsibility to ensure steady growth

UVA sustains a long-term investment strategy so that our endowment’s value grows steadily over time, providing a reliable income stream. In our case, we maintain a 6.5 to 7.5% long-term return on our investment, carefully managed through UVIMCO, the University of Virginia Investment Management Company. This rate of return ensures that when balanced with a 2 to 3% annual inflation rate, we can count on an annual distribution rate of 3 to 5%.

Spending to support excellence & affordability

UVA distributes approximately $200 to $250 million of the expendable endowment funds per year. The difference between the long-term investment return and the spending rate is re-invested so the endowment will provide a sustainable level of support after inflation to students, faculty and patients in the future. The balance between spending and re-investing is an important decision as we consider inter-generational equity: how much to spend today versus how much to preserve for future students.