Personal transactions should not be made with your T&E card, including when Mixing Personal Travel with University Paid Travel. Your card may be suspended and additional training required, if three personal transactions occur in the same year.

**Non-Employee Cardholders, scroll down to the bottom for instructions.

UNIVERSITY EMPLOYEE CARDHOLDERS:

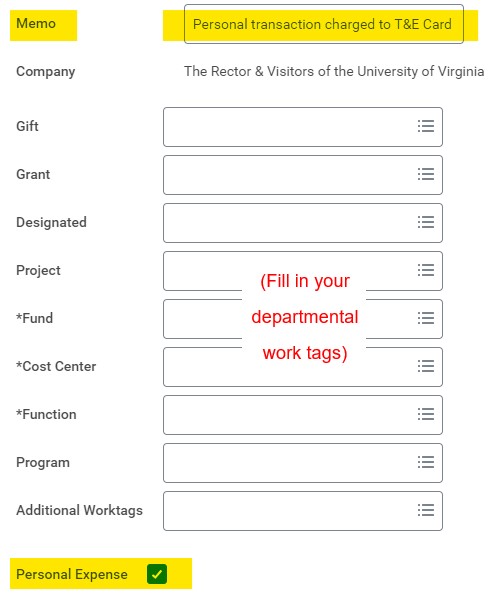

If a personal transaction is made on the card, you MUST check the box "Personal Expense" in Workday Expenses. Personal transactions will be deducted from your Payroll. *Please see separate instructions below for non-employee cardholders.

- Create an expense report in Workday Expenses for the personal transactions that were accidentally charged to the T&E card.

- Check the box "Personal Expense" on each line that has a personal transaction. This will deduct the amount of the transaction from the cardholder’s next paycheck.

- In the Memo field, indicate that the card transaction was a "personal transaction charged to T&E card by mistake".

- Once the expense report is fully approved, the charge will be sent to Payroll for deduction from the cardholder's paycheck.

Example:

NON-EMPLOYEE CARDHOLDERS:

If a personal transaction is made on the card, expense the transaction to the Sponsoring Department's worktag. It will then be the Sponsoring Department's responsibility to obtain a refund from the cardholder. If the Sponsoring Department has a Remote Deposit Scanner (RDS), they should use this to deposit the funds used to the worktag. If the Sponsoring Department does not have a Remote Deposit Scanner (RDS), find more information on the Cashier's Office website about how to request one. Do not check the box "Personal Expense" in Workday Expenses.