- Why is Worker Position - Period Activity taking precedence over the costing allocation I had set up?

-

Workday follows a costing allocation hierarchy. If an employee is receiving pay through a Period Activity Pay, this takes precedence over any other costing allocations that may be set up for that worker (Ex. A Worker Position costing allocation). This gives the opportunity to enter costing overrides on the Period Activity Pay for how you want that pay to be charged. If no costing override is entered on the Period Activity Pay, the Worker Position costing allocation will be used. If the Costing Override has been entered but needs to be changed, refer to the instructions on Editing a Period Activity Pay.

- Why is my To Do step not clearing from my Inbox once I have completed the task?

-

Certain costing allocation business processes will trigger a To Do task to appear in your My Tasks inbox (Ex. Assign Worker Position Earning Costing Allocation for FWS Overage). When you complete that task, the inbox message does not automatically disappear from your inbox. You need to manually clear it out of your inbox by clicking Submit within the task message.

- I received a Notification asking me to enter a Costing Allocation for a One-Time Payment from offer. What do I do?

-

When a One-Time Payment is initiated from an offer or hire business process, you will need to manually enter a Worker Position Earning costing allocation (unlike other One-Time payments that route to your inbox for you to enter the costing into the One-Time Payment itself). Follow the instructions for entering a Worker Position Earning costing allocation. The notification will provide the necessary details (worker, position, and earning) to complete this task. You will receive a separate task in your My Tasks inbox asking you to set up the Worker Position costing allocation as part of the hire business process.

- How do I delete an in-progress Costing Allocation?

-

There are two ways to do this:

1) From your inbox task:

a. Find the Revise Costing Allocation task in your My Tasks inbox, then click on the gear icon in the upper right corner.

b. Select “Delete Incomplete”

c. Click OK to confirm that you want to delete the incomplete business process.

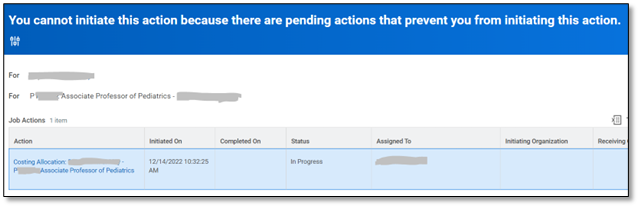

2) If you’ve tried to initiate another costing allocation with one already in progress, you will receive this error:

a. Hovering over the Action will reveal three dots. Click on the three dots.

b. Hover over Business Process, then click on Delete.

c. Click OK to confirm that you want to delete the incomplete business process.

- Why do I see the journal source “Payroll Forward Accrual” on my Account Cert?

-

This appears for a Medical Center employee or position is funded by Academic or UPG FDM strings. The forward accruals functionality is used by the Medical Center to estimate payroll costs through the end of a financial reporting period, but while these expenses may appear as part of month-end close, they are reversed out with an accounting date of the 1st of the next fiscal period.

If you see this on an Account Cert, you simply need to verify that the Payroll Actual Accrual journal source expenses are correct. There is no other action on your end for the Forward Accruals.

- Why is my worker’s pay not hitting the costing allocation I had set up on their new position?

-

If the start date that was selected in the Add Job business process is not a Monday (Academic Division/Wise) or Sunday (MC or UPG), the costing allocation may hit default account for days prior to the position start date and need to be adjusted.

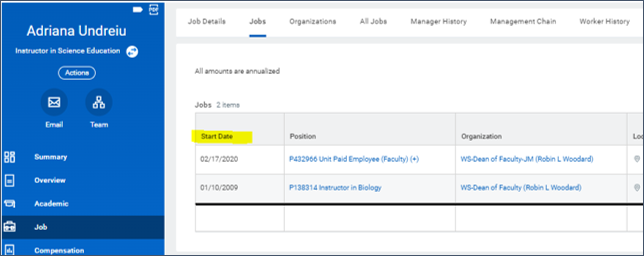

To verify the Start Date for a position, look up the employee in Workday, then select Job from the blue menu on the left. Clicking on the Jobs tab will display each Position and the Start Date:

- On my Account Certification, I see amounts posted to 5004: Employee Benefits, Fringe Benefits Wages Employee (SC0086) with a Journal Source of “Allocation” and the Operational Transaction is “Employee Recognition Awards Frings Rate Assessment…” Where is this coming from?

-

Most likely these are related to a taxable gift. To verify, you can run the Details for Account Certification report for the impacted worktags and find transactions that originally posted to Spend Category: Employee Recognition Awards Cash & Non Cash taxable (SC0564). These amounts are often related to gift cards that are taxable to employees and therefore, the expenses are assessed the wage fringe rate. This does not occur until month-end close, which is why you’re seeing it now on your Account Certification.