If you have deposited revenue, you may come across times that you need to refund the customer. The process for refunding the money is different depending on how the revenue came into the university.

Customer Accounts (formerly Accounts Receivable)

If the revenue came in through Customer Accounts, you would use the task Create Customer Invoice Adjustment being sure to select Refund as the Adjustment Reason. This will prompt a To Do Step to the Accounts Receivable Specialist for creating a customer refund. You can find a QRG for this process here.

Credit Card Deposits

How you process the credit card refund will depend on how that credit card revenue came into the university and how long ago the transaction occurred.

If it's an online credit card transaction, a refund can be performed through the point-of-sale system.

If it's a refund through a physical device, the refund is performed through the physical device. The card information will need to be re-entered into the device in that case (either the card is present, or an employee has the cardholder on the phone and is directly entering the card information into the device).

Both online and physical device refunds can occur up to 180 days after the transaction. That is a bank limitation and cannot be extended.

After 180 days, any credit card refund would have to go through the same process as non-credit card department deposits listed below.

Non-Credit Card Department Deposits

If you have submitted the Ad Hoc Bank Transaction for department deposit for non-credit card revenue you will have to create a Supplier Invoice Request.

Forms of revenue should be refunded using Supplier invoice Request:

- Checks scanned via remote deposit scanner

- Deposits physically taken to the bank

- Credit card revenue over 180 days after the original credit card transaction

A few things to note:

You will have to ensure that the customer is a vendor in our system.

You need to have a procurement security role to complete this task (P2P $10K Requisitioner or P2P $5K Requisitioner). If you do not have the role, you will either need to complete a System Access Request to request the role or have someone else in your area with a procurement security role complete the Supplier Invoice Request.

You can find the Create Supplier Invoice Request QRG here.

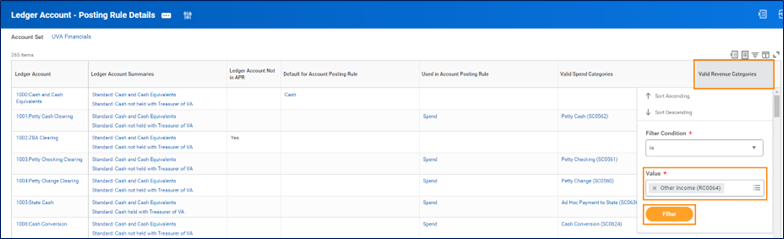

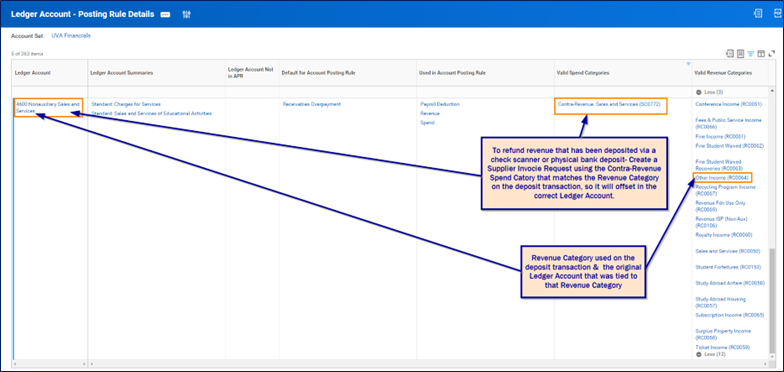

When Creating the Supplier Invoice Request, select the contra-revenue Spend Category that matches the Revenue Category and Ledger Account that you entered on the Ad Hoc Bank Transaction. If you moved the funds after the Ad Hoc Bank Transaction using an Accounting Journal, you would use the contra-revenue Spend Category that matched the Revenue Category on the Accounting Journal. You can find that information by pulling the Ledger Account – Posting Rule Details report and filtering by the Revenue category or Ledger Account on the final spot for the revenue (either the Ad Hoc Bank Transaction or Accounting Journal).