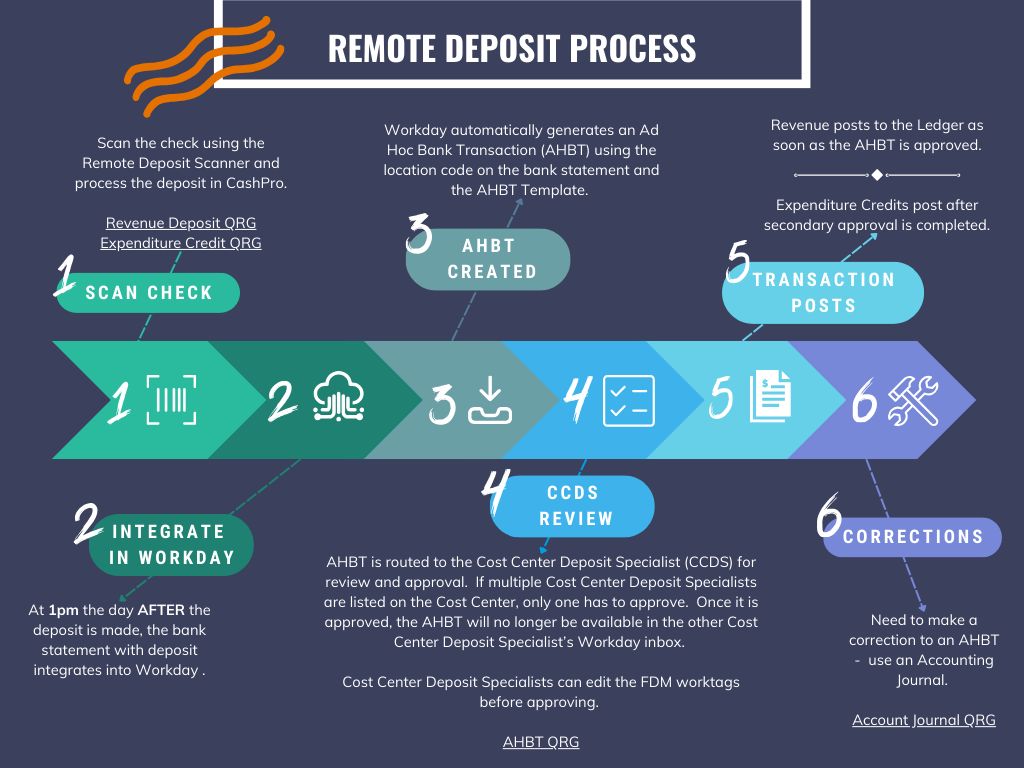

See the full process of remote deposits from scanning the check to any corrections that need to be made to the Ad Hoc Bank Transaction.

Remote Deposit Process:

1. Scan Check

Scan the check using the Remote Deposit Scanner and process the deposit in CashPro.

2. Integrate in Workday

At 1pm the day AFTER the deposit is made, the bank statement with the deposit integrates into Workday.

3. AHBT Created

Workday automatically generates an Ad Hoc Bank Transaction (AHBT) using the location code on the bank statement and the AHBT template.

4. CCDS Review

The AHBT is routed to the Cost Center Deposit Specialist (CCDS) for review and approval. If multiple Cost Center Deposit Specialist are listed on the Cost Center, only one has to approve. Once it is approved, the AHBT will no longer be available in the other CCDS's Workday inbox.

Cost Center Deposit Specialists can edit the FDM worktags before approving.

5. Transaction Posts

Revenue posts to the Ledger as soon as the AHBT is approved by Cost Center Deposit Specialist.

Expenditure Credits post after secondary approval is completed.

- For Designated or Allocated Gifts - Cost Center Manager approves

- For Non-Allocated Gifts - Unit Gift Manager approves

- For Projects - Project Budget Specialist approves

- For Grants - Grant Manager & Award Contract Specialist approves

- For Capital Equipment - Business Asset Account (Central Finance) approves

6. Corrections

If any corrections need to be made to an Ad Hoc Bank Transaction, you must use an Accounting Journal to correct.