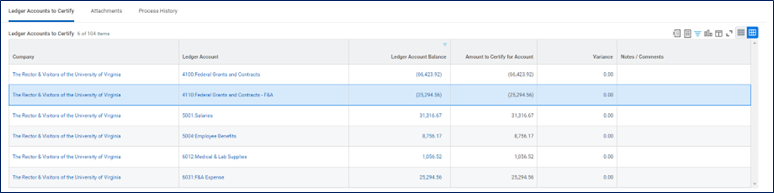

The 4100: Federal Grants and Contract ledger account, is where grant revenue is posted. This will look different depending on Contract Line Type. If the Grant is a Cost Reimbursable grant, you will see the amount in the 4100 ledger account line match the total expenditures including the F&A expenditures because this is the amount that will be reimbursed by the sponsor when invoiced by OSP. You may see this as 0.00 in the Total Ledger Account Balance. If the grant is a Fixed Amount grant, you will only see revenue matching the amount of the payment we received from the sponsor. Unlike Cost Reimbursable Grants, this revenue will not necessarily match the total of the expenditure and F&A.

(For information on responsibilities when reconciling grants, visit "What am I responsible for when reconciling for grants?".)

Example of a Cost Reimbursable Grant Account Certification:

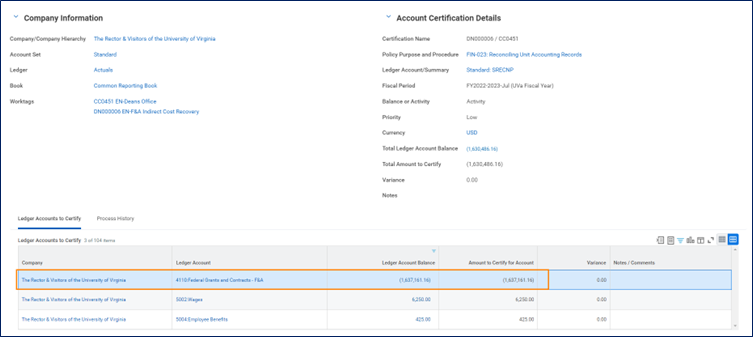

Example of a Fixed Amount Grant Account Certification where no grant revenue from sponsor was received):

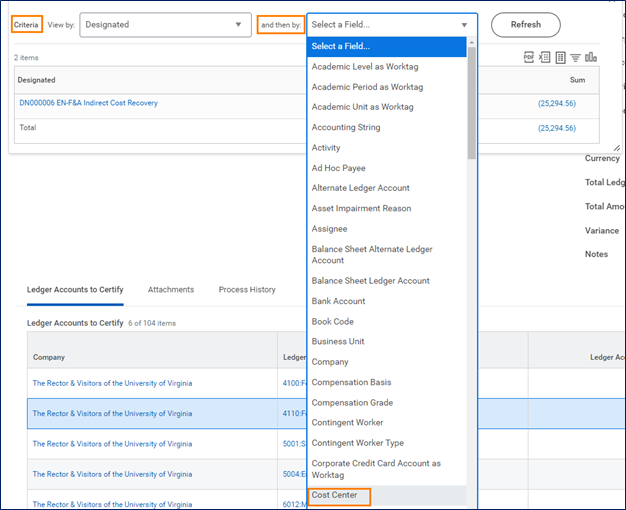

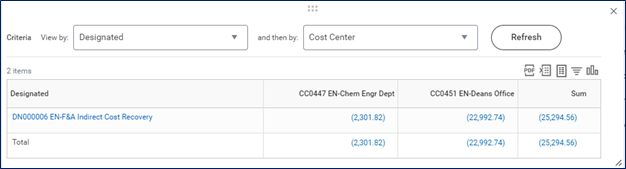

The 4110: Federal Grants and Contracts – F&A, is where the revenue earned from F&A is posted to the Designated/Cost Center combination. Why are you seeing on the grant Account Certification? You are seeing it on the grant Account Certification because the grant worktag is on the transaction, so it can easily be tied back to the grant, but the revenue does not belong to the grant. It belongs to the Designated. The Account certification pulls everything with that grant worktag for you to see. You do not have to do anything with this ledger account line. You can leave it as is. If you want to see where the F&A is going: Click on the down arrow beside the Ledger Account Balance, Scroll down in the View By box, and Select Designated. Once there you can: go to the Criteria line at the top of the popup window, Find the and then by: field, Select Cost Center, and Select the Refresh button.