Your focus when working on a Grant Account Certification should be on certifying that the expenditures in the expenditure ledger accounts are appropriate or marking a variance if they are not. The expenditure ledger accounts include the 5000-level payroll related ledger accounts & the 6000-level expenditure related ledger accounts. The one exception for the 6000-level ledger accounts is the 6031: F&A Expense Ledger Account. For this line, you are certifying that the amount you see roughly matches with what you would expect for F&A burdened on this grant. Example – if your grant has an F&A rate of 62% on Modified Total Direct Costs, you expect to see 62% of the MTDC that burden F&A. This is a check to make sure that F&A is being charged as you would expect to see it charged. You do not need to drill in or do any math to certify this line. Remember: The F&A revenue distribution process has changed. Your F&A revenue is automatically posted to the Designated as soon as the expenditure is posted. In Oracle, you had a monthly distribution for F&A revenue to the Designated.

Workday Account Certification brings in any transaction that has the Grant worktag on it, which is different than you are used to seeing. You may have noticed lines for the grant revenue in the 4000-level ledger accounts. Recon@ did not show you this information, and you were not required to reconcile grants in the General Ledger revenue reconciliation process.

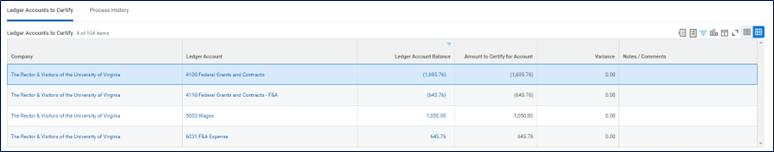

Primarily, the OSP team will be responsible for reconciling the grant revenue. This means that you do not have to do anything with the 4100 or the 4110 ledger account lines for Grant Account Certifications. You can leave them as is.

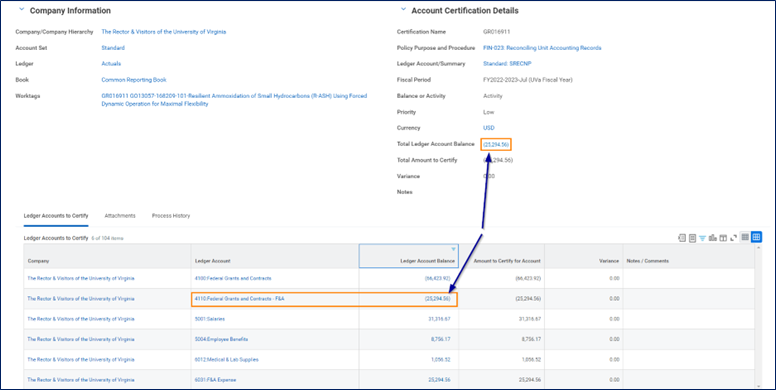

Due to revenue ledger accounts showing in the Account Certification, you may see your Account Certification show a Total Ledger Account Balance that is negative or looks like you have a credit. That’s okay! Often the accounts that show up like this are grants that are cost reimbursable, so the revenue we bring in that period will match the expenditures and the revenue for the F&A. The revenue generated from F&A expenditures (booked on ledger account 6031) will automatically get transferred to the Designated worktag per your Cost Center’s F&A Revenue Allocation Profile. You are likely seeing that amount that matches the 4110 ledger account amount (or the amount of the F&A moved to the Designated) as the Total Ledger Account Balance. So again – your main focus is reviewing/approving the expenditure level ledger account details.

A quick review of how to certify grants:

- Review & Certify expenditures in the 5000-level and 6000-level ledger accounts are appropriate

- You can skip the 4000-level revenue ledger accounts

- Quick check on ledger account 6031: F&A Expense to ensure the F&A is burdening the way you expected

- Don’t worry about the Total Ledger Account Balance at top of the Account Certification.

For information on revenue ledger accounts seen in grant certification, visit here.