It is important to know how to read and understand how Endowments come through in Workday, so you can understand your reports and your account certifications.

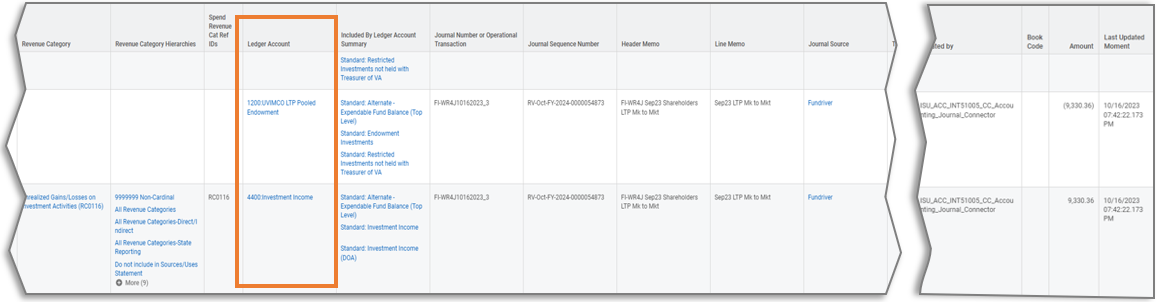

Endowments are managed in Fundriver. You can find more about Fundriver HERE. Any endowment investment activity comes into Workday via an integration from Fundriver. If you pull an Endowment Gift account in the General Ledger Details report, you will see activity with the journal source Fundriver. You will see the LTP or Long-Term Pool activity for the month moving the gains or losses from the 4400: Investment income ledger account into the 1200: UVIMCO LTP Pooled Endowment ledger account. Essentially, this is rolling the gains or losses back into the investment. You will also see movement between ledger accounts for the different fees associated with the Endowment. The funds you see in these ledger accounts (they will have the Journal Source, Fundriver) are not spendable endowment distribution and are not visible in the Fund Balance reports or your Account Certifications. If you want to see how to find Endowment Investment income activity, click HERE.

Image (below): A Portion of General Ledger Details Report for an Endowment Gift account.

Now let’s talk about the spendable endowment distribution.

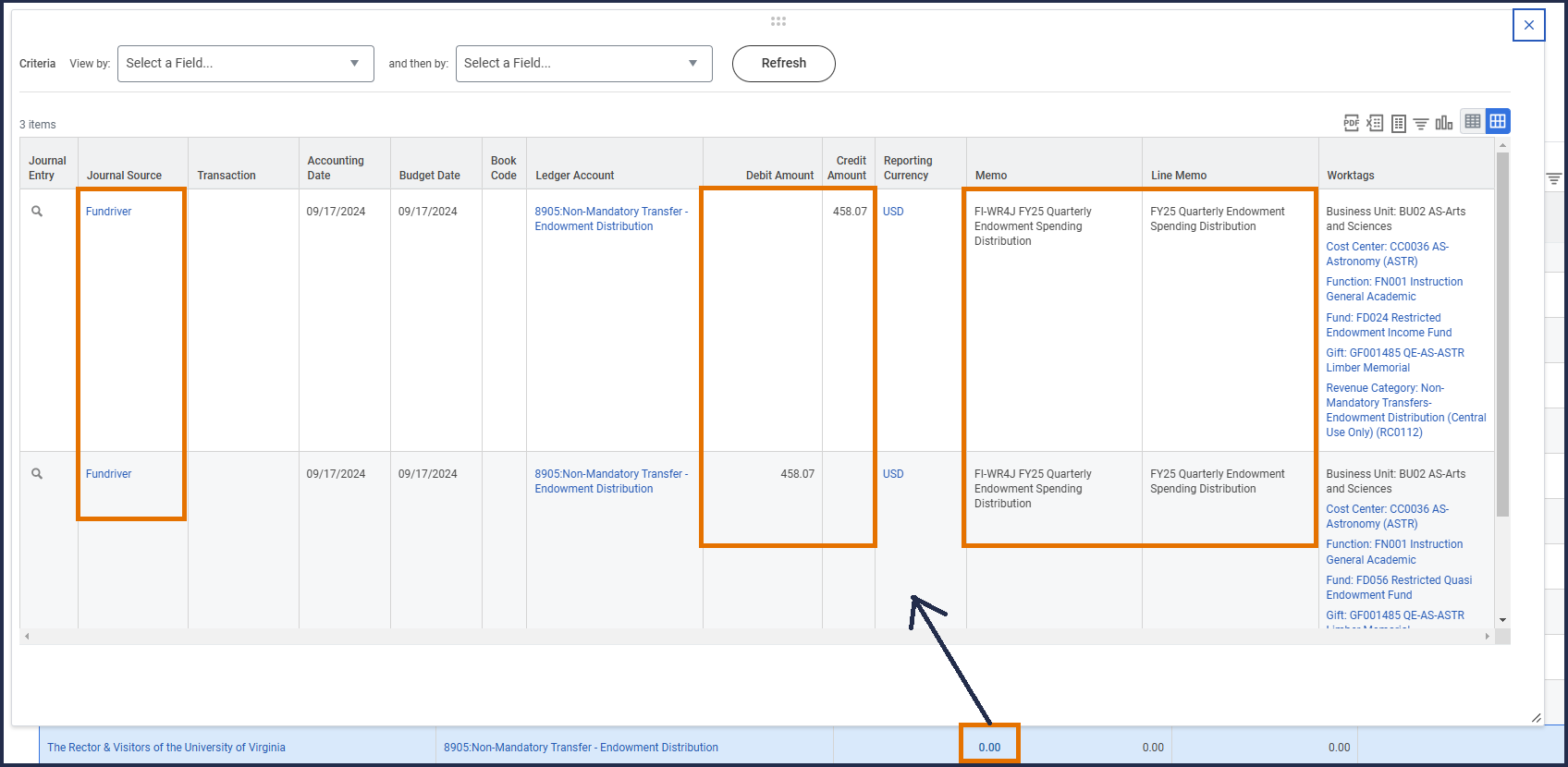

In July, the full amount of the fiscal year’s endowment distribution will be put into the 2996: Endowment Distribution Payable ledger account, using Fund FD024 Restricted Endowment Income Fund (or FD007 Unrestricted Endowment Income Fund). This Fund is visible in the Fund Balance Reports, so you will see the entire year’s distribution in your Fund Balance at the beginning of the Fiscal Year. This allows you to spend the endowment distribution starting at the beginning of the fiscal year without waiting for the triannual distribution. However, we don’t redeem the full yearly distribution from the investment right away. This allows the cash to remain invested longer. Three times a year a portion of the funds are moved from the payable ledger account to the spendable, 8905: Non-Mandatory Transfer - Endowment Distribution ledger account. In September and December, one quarter of the year’s distribution is dispersed. Then in March, the remaining half is dispersed. This is when the cash is redeemed from the investment. The total Fund Balance (Beginning Balance plus any Fiscal Year to Date Actuals) will not change during the triannual distributions.

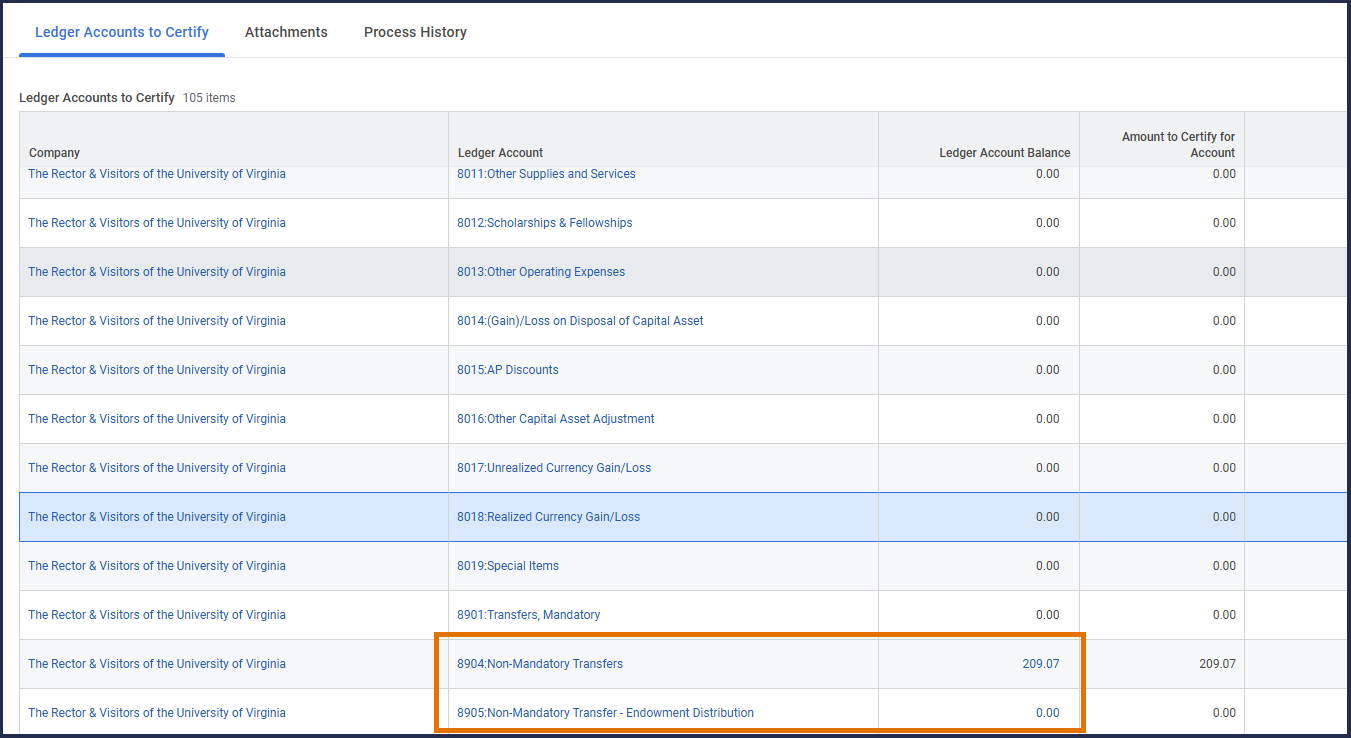

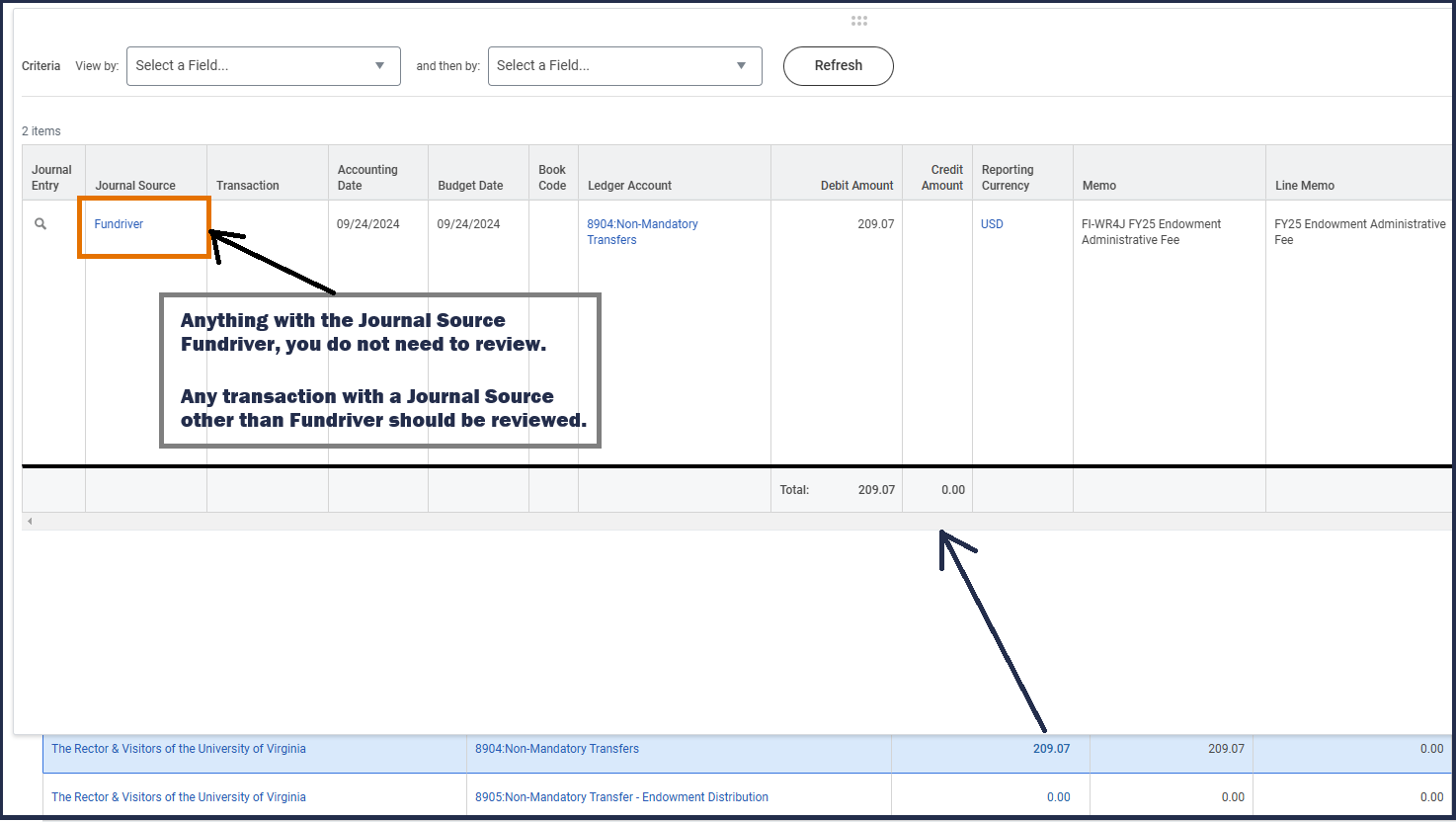

Most months you will not see an Account Certification if the only activity was activity, you do not need to review, such as the activity in the 4400 Investment Income ledger account. Due to the way Account Certifications are created, you will see some lines of activity when the triannual endowment distribution happens. You will see an Endowment Administrative Fee that is charged using the 8904: Non-Mandatory Transfer ledger account with the Journal Source: Fundriver. This amount will be included in Total Amount to Certify, but you are not required to review and certify this information. If there are other transaction in 8904 ledger account with a Journal Source other than Fundriver, you should review that information while certifying the account. You can also see the distribution in 8905: Non-Mandatory Transfer ledger account. This activity nets to zero in the Account Certification, so if you filter the Account Certification to <> (not equal to) 0, you will not see this activity. You can scroll down to the 8905 ledger account and click on the blue link for 0.00 to see the activity. You are NOT required to review or certify any transactions with the Fundriver Journal Source. These transactions are reconciled in central finance.

Image (below): Account Certification with ledger accounts 8904 and 8905 in an Endowment Distribution Month

Image (below): 8904 ledger account pop out with Admin Fee and Journal Source Fundriver

Image (below): 8905 ledger account pop out with Endowment Distribution and Journal Source Fundriver