Wednesday, July 2, 2025 : Payroll Accounting Adjustments are not expected to be available on July 3 as previously planned, due to an error within Workday. We are working as quickly as possible to fix the issue. Watch this space for updates. Please direct questions to askfinance@virginia.edu

Resources

- What's Changed?

For Account Certifications created before Feb. 1st, 2024, Account Certifications pulled in activity that are in

the Standard: SRECNP Ledger Account/Summaries.

Now that the investment income ledger accounts have been suppressed from Account Certifications, you may want to see that activity. Note: This information does not need to be reviewed as it is reconciled in central finance and is rolled back into the investment.

The Investment Income Ledgers that have been suppressed are:

4400: Investment Income

It is important to know how to read and understand how Endowments come through in Workday, so you can understand your reports and your account certifications.

The approver for some transactions (i.e., Account Certifications, Accounting Journals, etc.) with a Gift worktag will depend on whether the Gift is in the Allocated Gifts hierarchy.

-

Gift in the Allocated Gifts hierarchy, the approver will be the Cost Center Manager.

-

Gift NOT in the Allocated Gifts hierarchy, the approver will be the Unit Gift Manager.

This white paper answers questions about expendable fund balance and explains the basis of accounting and report parameters for expendable fund balance.

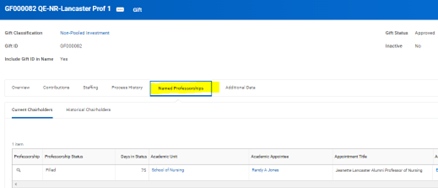

The Primary Gift will have a new attribute tab labeled “Named Professorship”

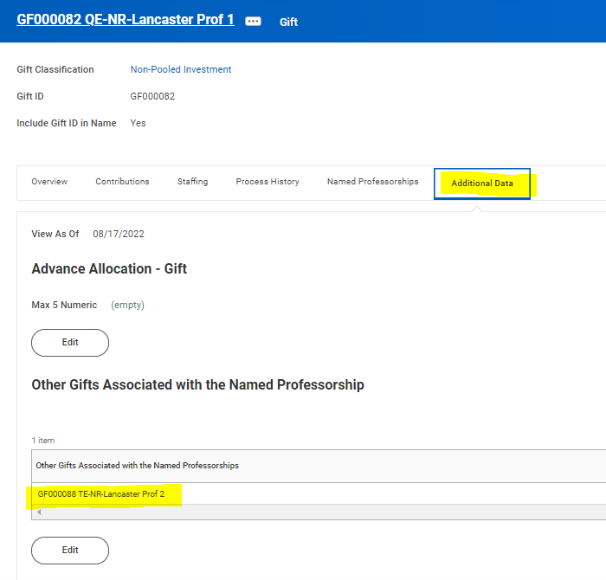

Any additional Gifts associated will be identified in the “Addition Data” tab on the Primary Gift

All Named Professorships will be flipped from being linked to a Basic Gift to the Workday Financials Gift Worktag. To preserve specific information for HCM during that flip, they have asked that we add a naming convention to the Named Professorships.

Units will see the Primary Gift linked to the Named Professorship. When Gifts are linked to Named Professorships, the Gift Worktag gets a new “tab” on the Worktag landing page which will allow users to navigate back and forth between Gift and Named Professorship. This does not impact any accounting functionality; it's just to aid in navigation.

See Policy FIN-001: Determining if an Award is a Gift or Sponsored Project

A Gift is defined as: an irrevocable transfer of assets (cash, stock, gifts, etc.) to the done such that the donor can exercise no further control over it and does not have expectation of any contractual requirements or potential benefits. To be tax deductible it must be donated to an organization recognized as charitable by the IRS (a 501(c) (3) corp).