Wednesday, July 2, 2025 : Payroll Accounting Adjustments are not expected to be available on July 3 as previously planned, due to an error within Workday. We are working as quickly as possible to fix the issue. Watch this space for updates. Please direct questions to askfinance@virginia.edu

Resources

Account Certifications Approver (Video Demonstration)

The view of the Account Certification Awaiting Me and the Account Certification Awaiting Me – Detailed reports are limited to 100 Account Certifications on the Account Certification Actions dashboard. However if you follow these steps, you can get your full list of the Account Certification that are awaiting you.

On the Account Certification Actions Dashboard

As the Preparer for Account Certification, you can work on the Account Certification until you press Submit and send it forward to the Approver. If for some reason you find that an Account Certification is no longer available to you, but you still need to work on it, the only option is to have the Approver send it back to you. Unfortunately, the Central Finance Account Certification team cannot step in and send the Account Certification back to you. You will need to contact the Approver, and ask them to open the Account Certification and select the Send Back button. <

This white paper answers questions about expendable fund balance and explains the basis of accounting and report parameters for expendable fund balance.

Most likely these are related to a taxable gift. To verify, you can run the Details for Account Certification report for the impacted worktags and find transactions that originally posted to Spend Category: Employee Recognition Awards Cash & Non Cash taxable (SC0564). These amounts are often related to gift cards that are taxable to employees and therefore, the expenses are assessed the wage fringe rate. This does not occur until month-end close, which is why you’re seeing it now on your Account Certification.

November and December 2022 Account Certifications have been delivered and are ready to reconcile. Reviewing both months at the same time, might save some time in the review process. The steps are below. You can also see a video demonstration here.

- Type Details for Account Certification in the search bar.

On the Details for Account Certification screen

This appears for a Medical Center employee or position is funded by Academic or UPG FDM strings. The forward accruals functionality is used by the Medical Center to estimate payroll costs through the end of a financial reporting period, but while these expenses may appear as part of month-end close, they are reversed out with an accounting date of the 1st of the next fiscal period.

Check your level of security - if they are outside of your Cost Center or Cost Center Hierarchy, you would need Security Access at the Company level to process their PAA.

- Why is Worker Position - Period Activity taking precedence over the costing allocation I had set up?

This video shows how to review details for both months; use only if helpful.

{"preview_thumbnail":"/sites/uvafinance/files/styles/video_embed_wysiwyg_preview/public/video_thumbnails/4CYcejkAmzg.jpg?itok=ioSlisWp","video_url":"https://www.youtube.com/watch?v=4CYcejkAmzg","settings":{"responsive":1,"width":"854","height":"480","autoplay":0},"settings_summary":["Embedded Video (Responsive)."]}

This video illustrates how to work early on Account Certifications. This video was created for working on November 2022 Account Certifications when Account Certifications were stopped, but is true even when Account Certifications are created normally.

This PDF FAQ describes how to pull a report that will allow you to get started with November reconciliations that haven't been created due to the halt with the project multi-funding source engine.

If you see this error, when trying to look at your Account Certifications:

You have limited or no access to the Account Certification ledger balances. Please contact your Administrator.

No – you cannot add attachments or notes to the Account Certification after it’s been submitted.

Stakeholders can use this Cheat Sheet to determine which course(s) will best address their Workday Financials questions. These courses are available as self-paced training and can be searched by title in Workday Learning.

The Decision Tree maps out corrections paths for certain tasks. See file at the bottom of the page for a graphic decision tree.

Workday tasks used to correct the FDM worktags on posted transactions

Internal Service Delivery:

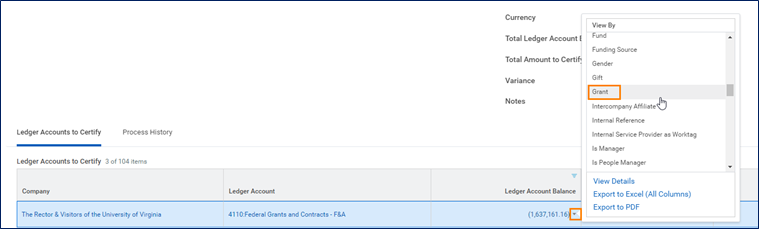

The 4100: Federal Grants and Contract ledger account, is where grant revenue is posted. This will look different depending on Contract Line Type. If the Grant is a Cost Reimbursable grant, you will see the amount in the 4100 ledger account line match the total expenditures including the F&A expenditures because this is the amount that will be reimbursed by the sponsor when invoiced by OSP. You may see this as 0.00 in the Total Ledger Account Balance.

Your focus when working on a Grant Account Certification should be on certifying that the expenditures in the expenditure ledger accounts are appropriate or marking a variance if they are not.

If you are a reconciling a Gift, Grant, or Designated, and you see Funding Source Reclassification transactions: