No – you cannot add attachments or notes to the Account Certification after it’s been submitted.

Resources

This Quick Reference Guide (QRG) is designed to walk a Procurement Shopper through the investigation of a supplier invoice match exception, determine the cause of the exception, and initiate the correction for the match exception. By the end of this QRG, you will be able to successfully find the supplier invoice that is in a match exception status, determine the cause of the match exception, and initiate the correction of the match exception.

This FAQ contains frequently asked questions pertaining to Match Exceptions. Use the table of contents below to control + click to go directly to that question and answer. For step-by-step guidance on how to find and address a match exception, review the Match Exception Investigation and Correction QRG. For details and updates on spend issues, refer to the Action Plan to Address Spend Issues page.

Stakeholders can use this Cheat Sheet to determine which course(s) will best address their Workday Financials questions. These courses are available as self-paced training and can be searched by title in Workday Learning.

The Decision Tree maps out corrections paths for certain tasks. See file at the bottom of the page for a graphic decision tree.

Workday tasks used to correct the FDM worktags on posted transactions

Internal Service Delivery:

If you have deposited revenue, you may come across times that you need to refund the customer. The process for refunding the money is different depending on how the revenue came into the university.

This cheat sheet is designed to help accountants determine when to perform an accounting adjustment versus creating or reversing a journal in Workday.

This Quick Reference Guide (QRG) is designed to walk users through the process(es) in Workday to ensure a new Cost Center is available to use in Adaptive Planning. When a new Cost Center is created in Workday, it is not immediately available in Adaptive Planning. The only way to get the Cost Center into Adaptive Planning is to complete a transaction. The preferred process is to enter any transaction that needs to be completed for the new Cost Center.

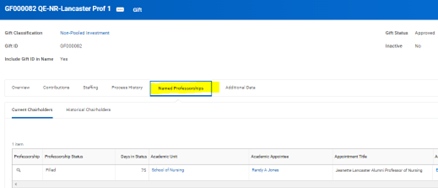

The Primary Gift will have a new attribute tab labeled “Named Professorship”

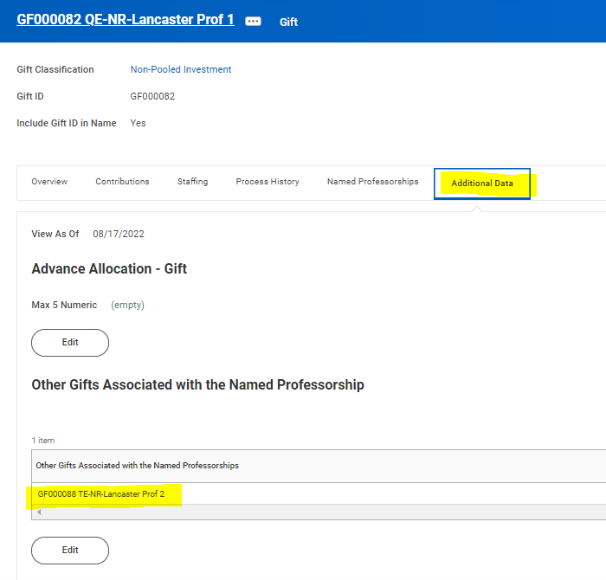

Any additional Gifts associated will be identified in the “Addition Data” tab on the Primary Gift

All Named Professorships will be flipped from being linked to a Basic Gift to the Workday Financials Gift Worktag. To preserve specific information for HCM during that flip, they have asked that we add a naming convention to the Named Professorships.

Units will see the Primary Gift linked to the Named Professorship. When Gifts are linked to Named Professorships, the Gift Worktag gets a new “tab” on the Worktag landing page which will allow users to navigate back and forth between Gift and Named Professorship. This does not impact any accounting functionality; it's just to aid in navigation.

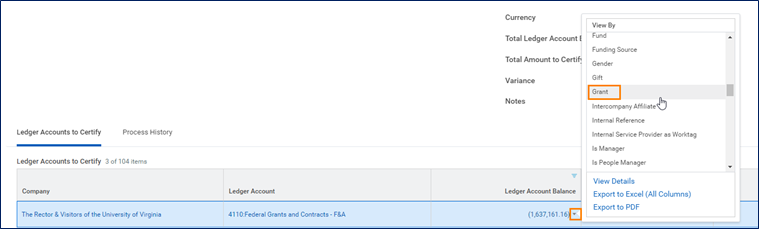

The 4100: Federal Grants and Contract ledger account, is where grant revenue is posted. This will look different depending on Contract Line Type. If the Grant is a Cost Reimbursable grant, you will see the amount in the 4100 ledger account line match the total expenditures including the F&A expenditures because this is the amount that will be reimbursed by the sponsor when invoiced by OSP. You may see this as 0.00 in the Total Ledger Account Balance.

Your focus when working on a Grant Account Certification should be on certifying that the expenditures in the expenditure ledger accounts are appropriate or marking a variance if they are not.

If you are a reconciling a Gift, Grant, or Designated, and you see Funding Source Reclassification transactions:

The United States has tax treaties with several foreign countries. Under these treaties, residents (not necessarily citizens) of foreign countries are taxed at a reduced rate, or exempt specific income amounts of U.S.-sourced income and/or scholarship/fellowship payments from taxation.

This Quick Reference Guide (QRG) is designed to walk an Expense Support Specialist through the approval process in Workday for Supplier Invoice Requests for non-employees. By the end of this QRG, you will know how to review and approve a supplier invoice request for non-employees.